tax avoidance vs tax evasion examples

Tax Evasion vs Tax Avoidance. Tax evasionThe failure to pay or a.

Aggressive Tax Avoidance By Managers Of Multinational Companies As A Violation Of Their Moral Duty To Obey The Law A Kantian Rationale Springerlink

Payment of tax is avoided though by complying with the provisions of law but defeating the intention of law.

. Tax Evasion is when a citizen tries to evade federal state and income taxes using illegal techniques. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the.

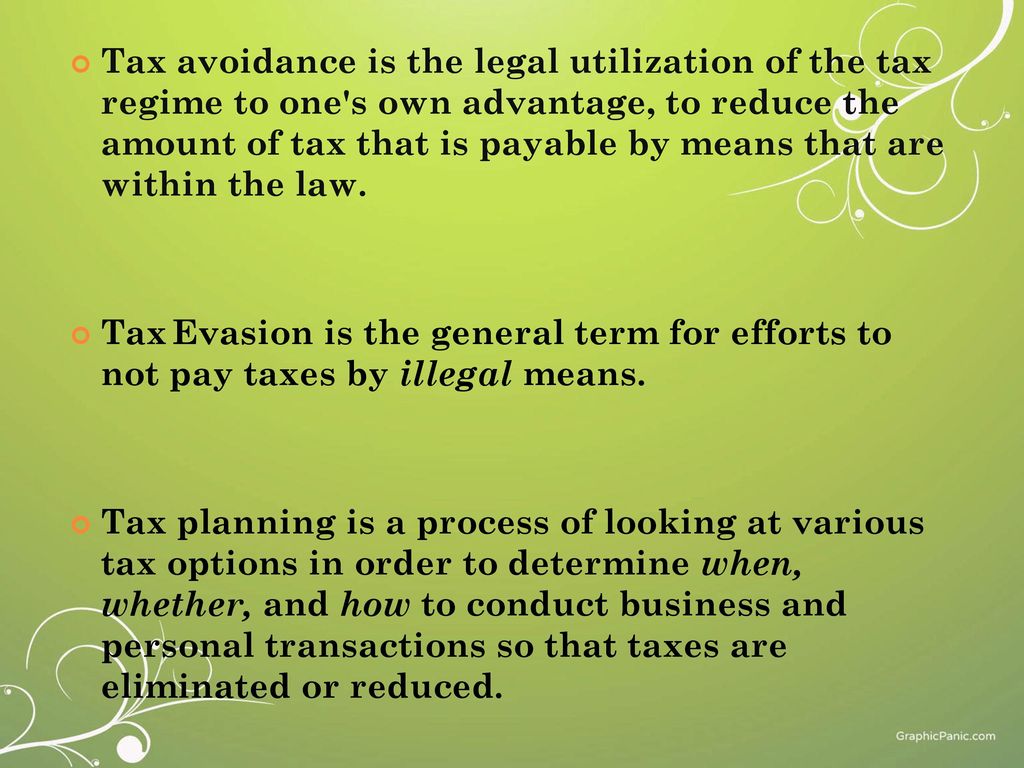

Tax evasion is the use of illegal means to avoid paying your taxes. Moreover one of the common examples of tax avoidance to minimize a taxable income is. Tax evasion is often confused with tax avoidance.

Tax evasionThe failure to pay or a deliberate underpayment of. Let us consider the following tax avoidance examples to understand the concept and the process better. To start with tax avoidance is legal while tax evasion is illegal.

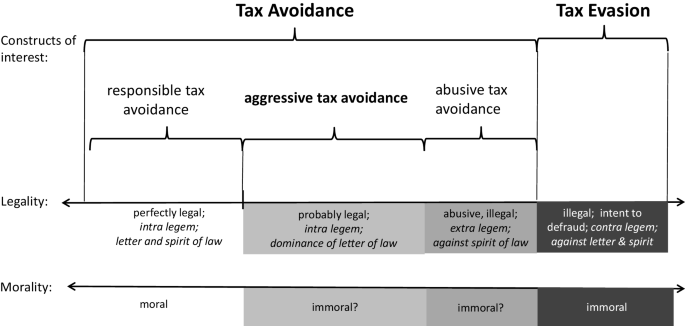

Tax avoidance and tax evasion are the two most common ways used by taxpayers to not pay taxes or pay reduced taxes. The difference between tax avoidance and tax evasion essentially comes down to legality. Hence check the details below to get to know about tax evasion vs tax avoidance.

Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Both tax evasion and tax avoidance aim to reduce ones taxes by lowering. Tax avoidance is another way of reducing your tax burden but in a very different way from tax evasion.

Tax evasion occurs when the taxpayer either evades assessment or evades payment. Tax avoidance is different from tax evasion. In tax avoidance you structure your affairs to.

What is tax avoidance vs tax evasion. Here are some examples of tax avoidance strategies. Tax Evasion vs.

Tax avoidance unlike tax evasion is a. It is a legal strategy that. Tax-advantaged retirement accounts including IRAs and 401ks allow you to reduce your.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Payment of tax is avoided through. One method to avoid taxes is not paying at all or paying less.

Tax avoidance is the use of tax-saving. Tax Evasion vs. Maximizing your retirement contributions.

Tax evasions and tax avoidances share similarities and differences. On 16 Feb 2022. Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object.

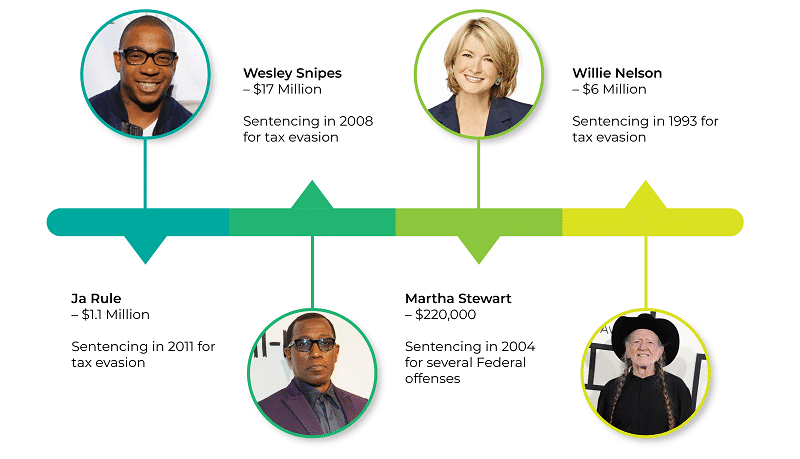

Tax evasion can lead to a federal charge fines or jail time. Avoiding tax is legal but it is easy for the former to become the latter. Tax evasion includes underreporting income not.

Tax evasion is a felony. Unlike tax evasion which relies on illegal methods tax avoidance is a legal method of reducing taxable income or tax owed by an individual or business.

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Which Countries Are Worst Affected By Tax Avoidance World Economic Forum

Difference Between Tax Planning And Tax Evasion L Tax Evasion

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Tax Avoidance Tax Evasion Ppt Download

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants

Irs Problem Resolution Archives Page 2 Of 4

Tax Evasion Vs Tax Avoidance Know The Difference Ico Services

Celebrity Tax Evasion Top 4 Celebrities Who Got Busted Updated 2022

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Avoidance Evasion What S The Government Doing