refinance transfer taxes florida

A pension plan for long-term workers and a defined contribution plan for shorter-service workers or people who do not plan on working for the state for more than six years. As far as inherited retirement accounts are concerned the heirs of such finances must pay income tax on the assets they withdraw.

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Your average tax rate is 1198 and your marginal tax rate is 22.

. The Loan term is the period of time during which a loan must be repaid. Be informed and get ahead with. Super Power Your Money.

Real estate transfer taxes are considered part of. EXPRESS Refi products are available for loans up to 11 Million. The most common is the quitclaim deed but some parents opt for a transfer on death deed which comes into effect after you pass away.

995 EXPRESS Refi fee waiver available for EXPRESS Refi transactions only. Offer is subject to credit approval and underwriting and is subject to change or termination at any time without notice. The comptrollers office will charge you a small fee for the recording.

Total costs around 7700. The rules of real estate transfer taxes vary by location. Florida is one of the few states that does not collect income taxes.

You are refinancing your existing loan. However its state and local tax burden of 89 percent ranks it 34th nationally. Unfortunately refinancing does not bring automatic.

At face value replacing high-interest debt with a low-interest mortgage is a good idea. Friendly Advice For Personal Loans Auto Loans Mortgage Debt Credit Refinance Tax Relief Insurance and More. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

Other things to know about Florida state taxes. The FRS also oversees the retirement plans for state university and community colleges and for. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably.

Retirement accounts payable-on-death bank accounts life insurance policies transfer-on-death accounts. For example a 30-year fixed-rate loan has a term of 30 years. Your taxes are 3600 a year and your homeowners insurance is 600 a year.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Lets examine their differences below. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based.

Most lenders have the ability to offer a credit at closing. First lets look at a refinance example. The comptrollers office records the deed into the countys official records.

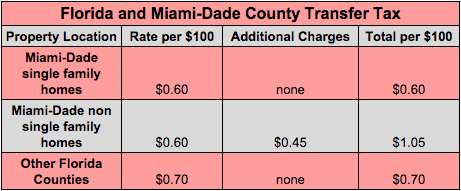

While a 480000 refinance in the Miami market may have all-in title recording and taxes of 6400-6900. As a result Florida had the eighth-lowest tax burden defined as the state and local taxes a resident pays divided by the states share of net national product in the US. A deed in lieu and a foreclosure arent the same.

To do this youll need to sign a deed transfer and record it with the county recorders office. Other Situations in Florida Inheritance Laws. The Florida Retirement System FRS offers two retirement plans for state employees.

Yes you can legally transfer the deed to your house to your kids before you die. If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. A deed in lieu means you and your lender reach a mutual understanding that youre no longer able to make your mortgage loan payments.

This marginal tax rate means that. Many homeowners refinance to consolidate their debt. Jointly-owned bank accounts or homes.

In Florida taxes are due once a year and there is a discount if taxes are paid by November 1 so your lender or servicer will assume you want to pay your taxes by that date. However expect a larger fee and transfer taxes if there is a mortgage on the property. In 2019 according.

Deed In Lieu Agreement. Purchase loans a refinance of an existing PFFCU portfolio loan or loans where there is a change to title do not qualify.

Should I Transfer The Title On My Rental Property To An Llc

Alabama Real Estate Transfer Taxes An In Depth Guide

Arkansas Real Estate Transfer Taxes An In Depth Guide

Transfer Tax And Documentary Stamp Tax Florida

Nevada Real Estate Transfer Taxes An In Depth Guide

Oklahoma Real Estate Transfer Taxes An In Depth Guide

Co Op Apartment Flip Tax Calculator Hauseit Nyc

Should I Transfer The Title On My Rental Property To An Llc

West Virginia Real Estate Transfer Taxes An In Depth Guide

Ever Wonder Who Pays What Fees In An Real Estate Closing Getting Into Real Estate Real Estate Exam Title Insurance

Ohio Real Estate Transfer Taxes An In Depth Guide

Hawaii Real Estate Transfer Taxes An In Depth Guide

Kentucky Real Estate Transfer Taxes An In Depth Guide

Transfer Tax And Documentary Stamp Tax Florida

Minnesota Real Estate Transfer Taxes An In Depth Guide

Oakland City Transfer Taxes An In Depth Guide

The Complete Guide To Closing Costs In Nyc Hauseit

Closing Costs For Home Buyers And Sellers Your Realtor For Generations Cheryl Facione Crs Gr Real Estate Infographic Real Estate Tips Real Estate Investing