japan corporate tax rate 2020

Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334 Table 3-5 applies. The tax rates applied to profit and loss sharing groups will be.

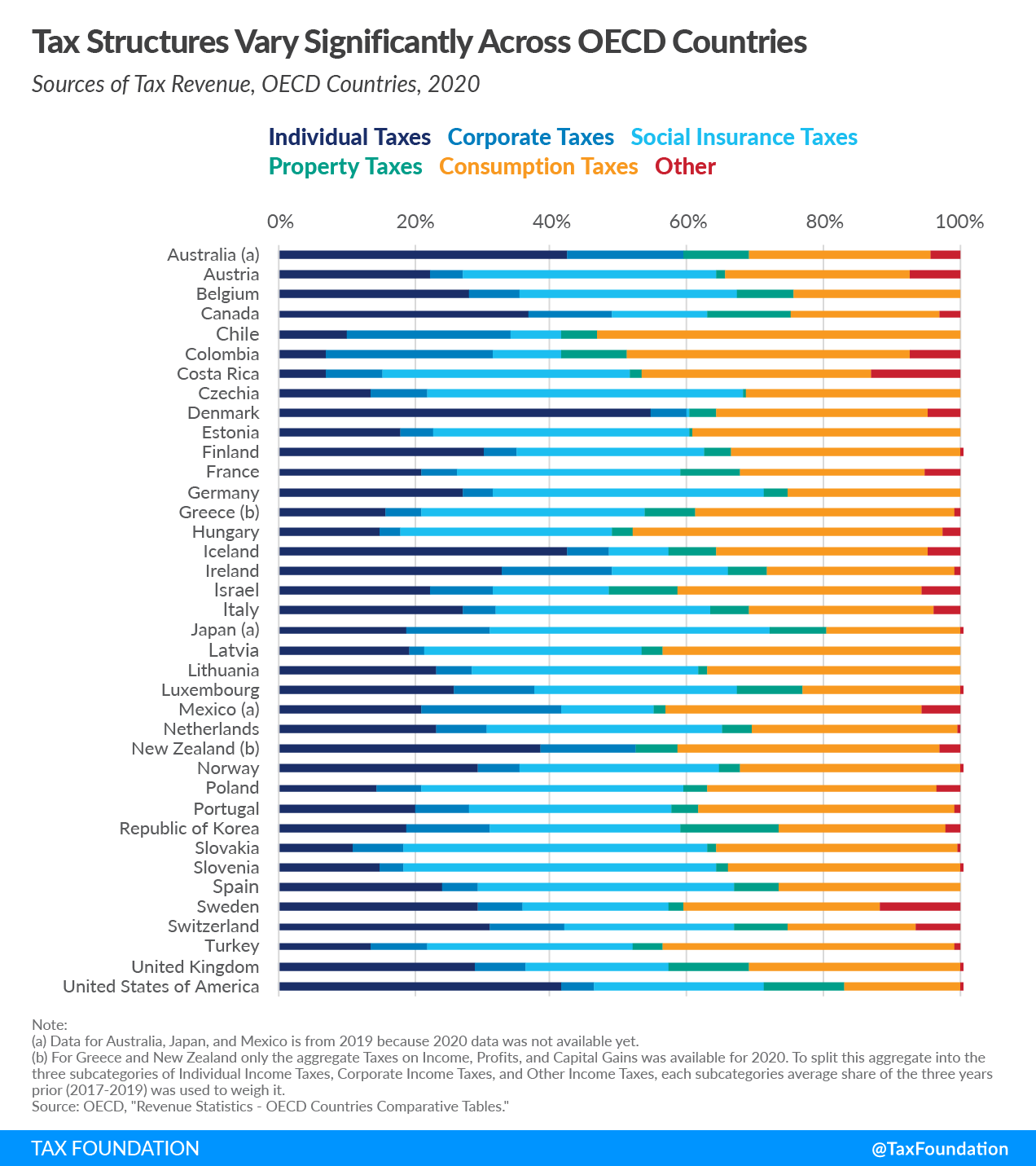

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

13 February 2020 Japan tax newsletter Ernst Young Tax Co.

. The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with taxable income over 10 million. Headline individual capital gains tax rate Gains arising from sale of stock are taxed at a total rate of 20315 15315 for national tax purposes and 5 local tax. A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in most countries are extremely complex and the tax burden falls differently on different groups in each country and sub-national unit.

Puerto Rico follows at 375 and Suriname at 36. Revision of the consolidated taxation. The list focuses on the main types of taxes.

2020 Japan tax reform outline. Capital gains tax CGT rates Headline corporate capital gains tax rate Capital gains are subject to the normal CIT rate. Consumption tax value-added tax or VAT is levied when a business enterprise transfers goods provides services or imports goods into Japan.

A corporate tax is a total tax applied to the profits of a company. As of 1 October 2019 the rate increased to 10. The tax rates for corporate tax corporate inhabitant tax and enterprise tax on income tax burden on corporate income and per capita levy.

Under the 2020 Tax Reform Act the currently effective consolidated tax regime would be abolished and replaced with a new regime of group relief group tax relief. Film royalties are taxed at 15. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate.

Diversity Equity Inclusion at Deloitte Japan. Excluding jurisdictions with corporate tax rates of 0 the countries with the lowest corporate tax rates are Barbados at 55 Uzbekistan at 75 and Turkmenistan at 8. Exports and certain services to non-residents are taxed at a zero rate.

Comoros has the highest corporate tax rate globally of 50. The corporate income tax is a tax on the profits of corporations. Global tax rates 2022 is part of the suite of international tax resources provided by the Deloitte International.

GIG is a specialist group established to respond to the various needs of foreign companies developing business in Japan. The tax treaty with Brazil provides a 25 tax rate for certain royalties trademark. Corporate tax individual income tax and sales tax including VAT and GST but does not list capital gains tax.

Fifteen countries do not have a general corporate income tax. Tax rates for corporate income tax including historic rates and domestic withholding tax for more than 170 countries worldwide. Corporate Taxation in Japan.

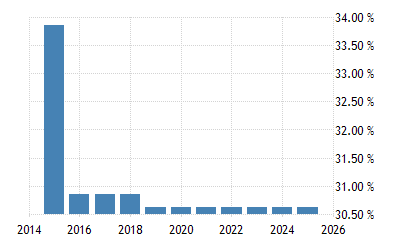

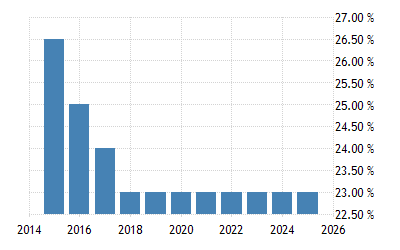

The new regime will be effective for tax years beginning on or after 1 April 2022. Japan also slowly decreased its corporate tax rate from 42 in 2003 to 3062 in 2019. However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties to be received by a non-resident taxpayer of Japan under Japanese income tax law.

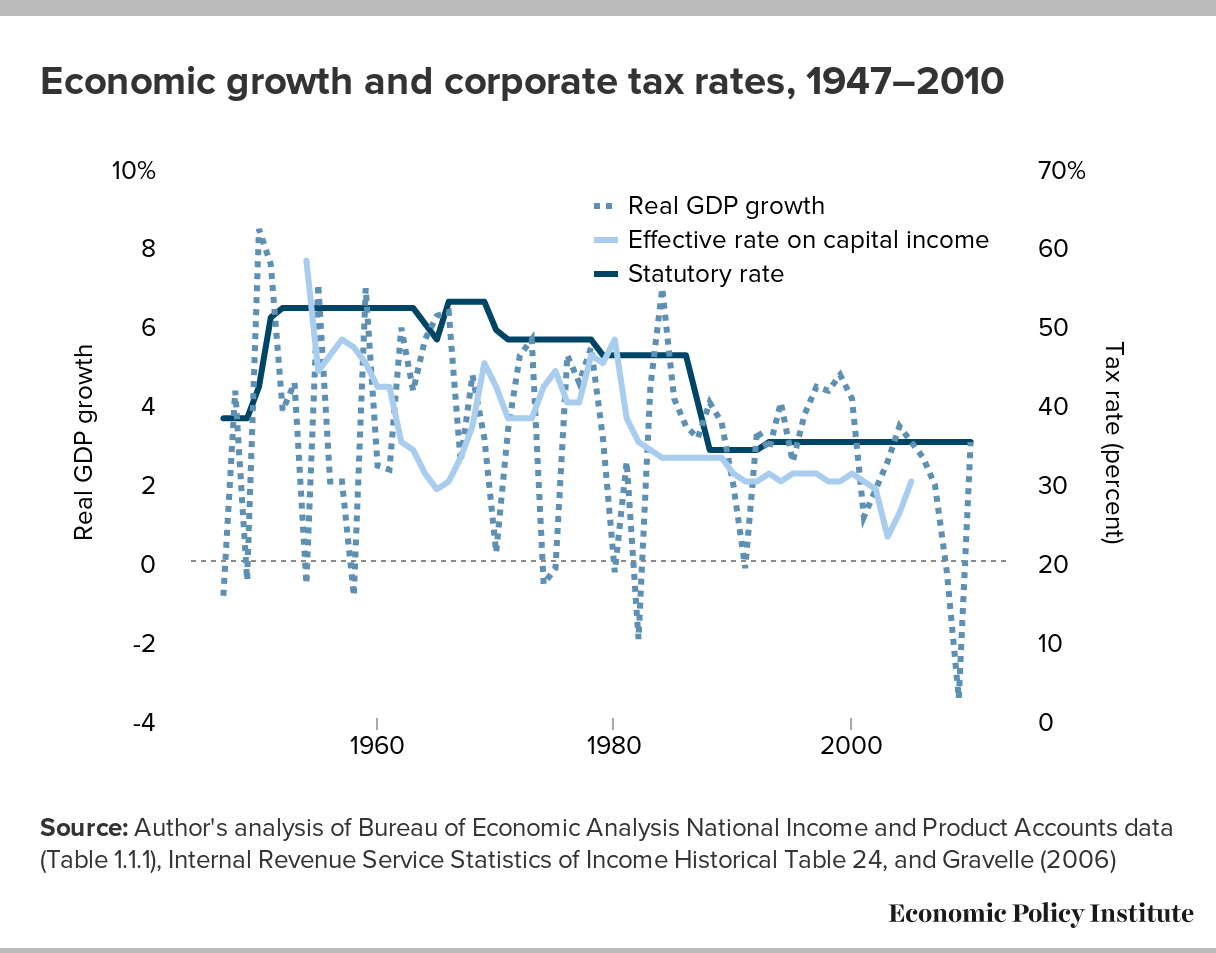

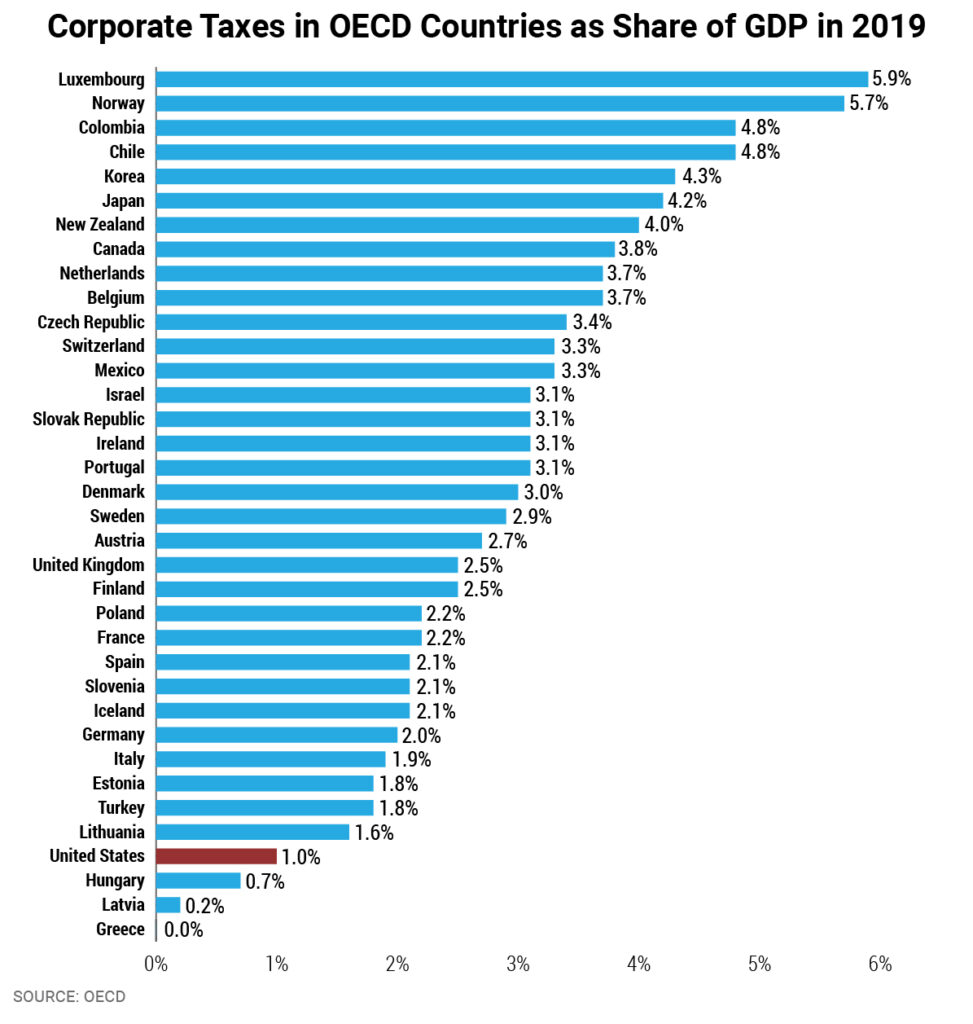

All OECD countries levy a tax on corporate profits but the rates and bases vary widely from country to country. What Is a Corporate Tax. 2 Japan tax newsletter 13 February 2020 Corporate taxation 1.

Corporate Tax Rates around the World 2020. For taxpayers who face difficulty paying their national tax due to the influence of the novel coronavirus disease COVID-19 Announcement of the event Learn and Taste Local SAKE in Chugoku RegionTottoriShimaneOkayamaHiroshima and Yamaguchi on 28 March 2020PDF2013KB Information about International Tourist Tax. The applicable rate is 8.

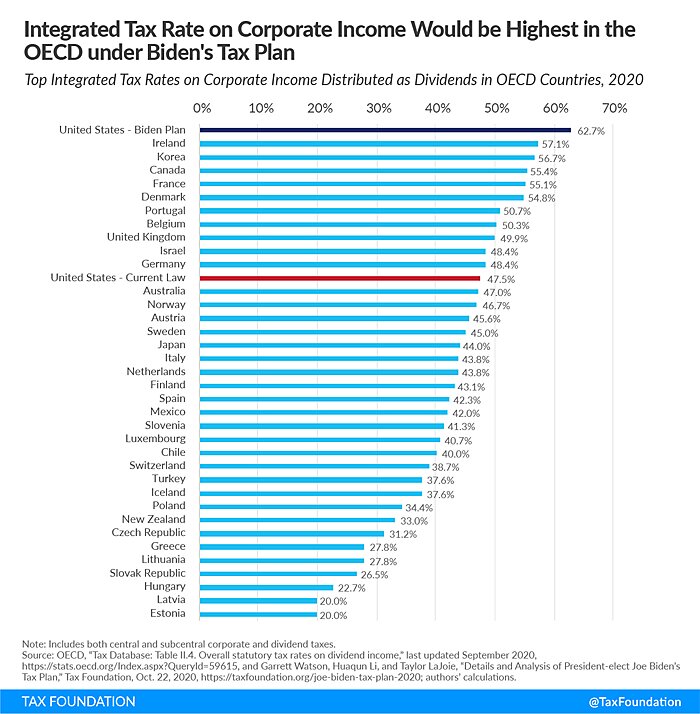

For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. Comparing Europes Tax Systems. Withholding Tax Rates 2022 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction.

Specified transactions such as sales. Corporate - Group taxation. Measures to transition from the current consolidated tax.

Malta Corporate Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical Chart

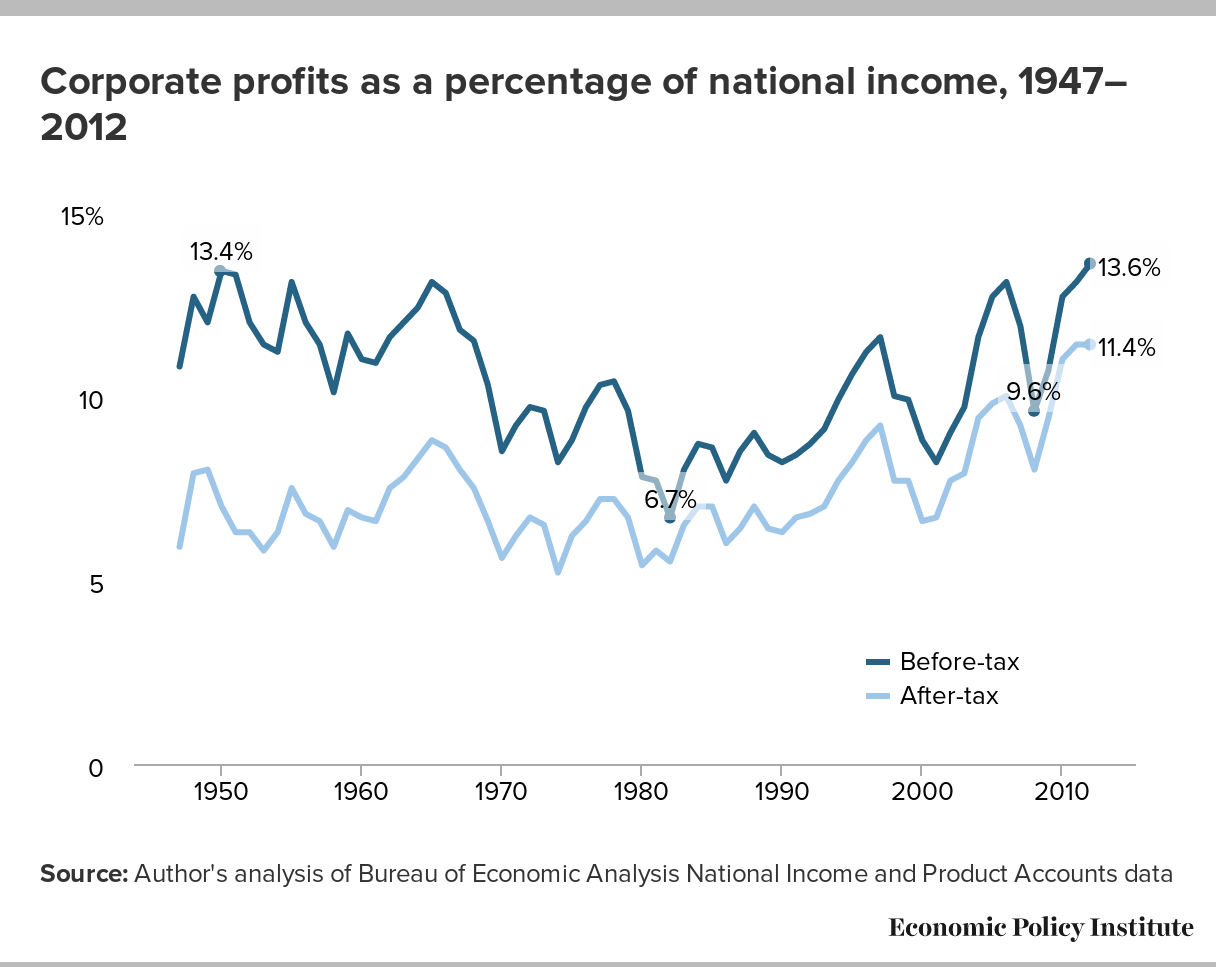

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Latvia Tax Income Taxes In Latvia Tax Foundation

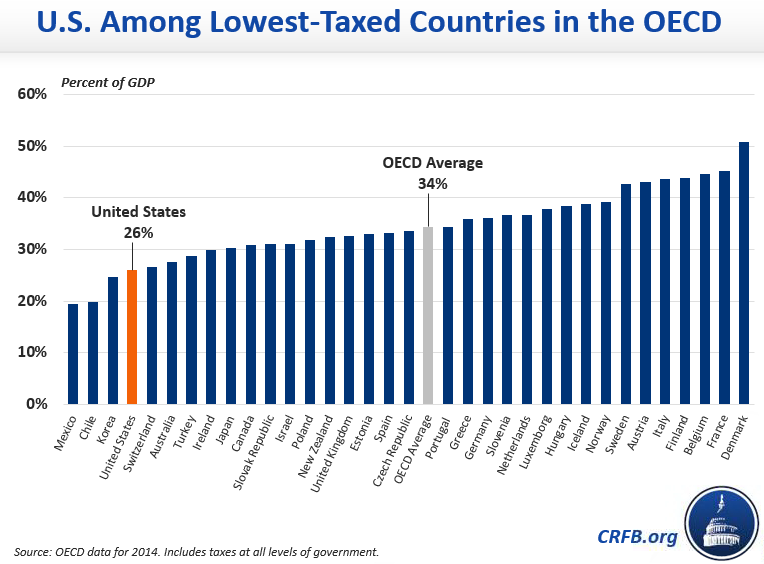

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Micronesia Business Gross Revenue Tax July 2022 Data 2020 2021 Historical

Latvia Tax Income Taxes In Latvia Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Japan National Tax Revenue Statista

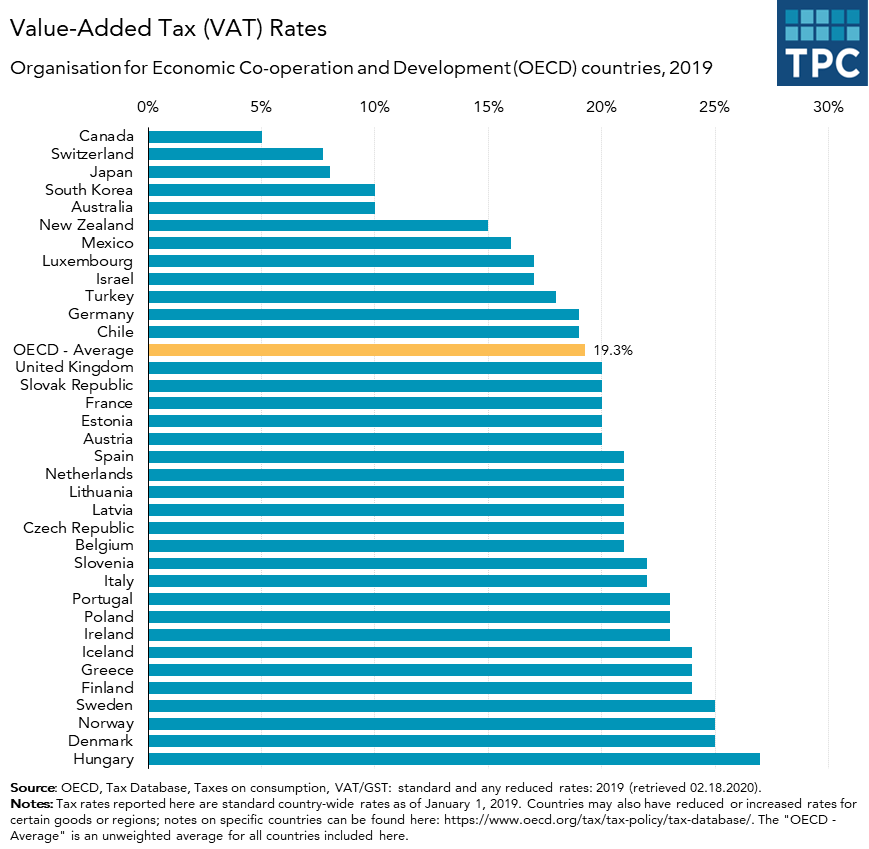

What Would The Tax Rate Be Under A Vat Tax Policy Center

Real Estate Related Taxes And Fees In Japan

Real Estate Related Taxes And Fees In Japan

日本 企业所得税税率 1993 2021 数据 2022 2024 预测

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

Taxing Corporations Might Be Good Politics But It S Still Bad Policy Cato Institute

Corporate Tax Reform In The Wake Of The Pandemic Itep

Israel Corporate Tax Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart